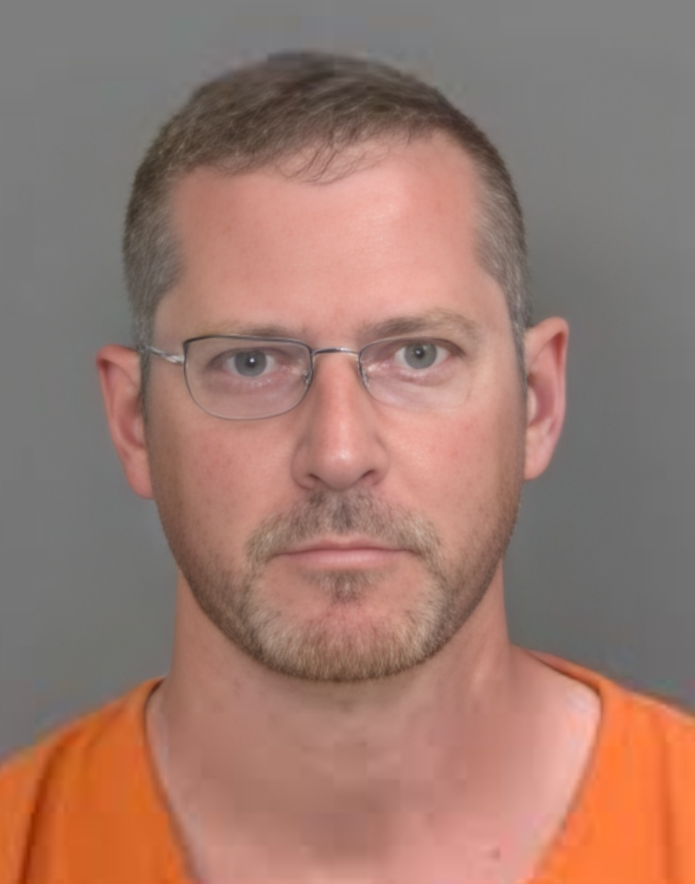

Jason Norbeck Fraud: Indicted in Major Federal Bank Fraud Case Scandal

Jason Christopher Norbeck has been indicted on federal charges for his alleged involvement in a sophisticated bank fraud scandal. The Jason Norbeck indictment is the result of a multi-layered scheme that spanned several years, leading to significant financial losses and disruptions in banking systems. Details of the Jason Norbeck Indictment and Alleged Fraud Scheme Federal prosecutors allege that Norbeck masterminded a complex fraud operation, exploiting weaknesses in financial systems. The scheme involved several illegal tactics, including: Fake Identities and Documents: Norbeck allegedly created counterfeit personal information to access accounts and perform fraudulent transactions. Unauthorized Access and Transactions: He is accused of illicitly transferring funds and withdrawing money from customer accounts. Loan and Credit Fraud: Prosecutors claim that Norbeck secured loans and credit lines using false information, then defaulted on repayment. Authorities suggest Norbeck may have had accomplices involved in the operation, and the investigation remains ongoing as they work to uncover further details. Impact of the Jason Norbeck Indictment on Victims and Financial Institutions The Jason Norbeck indictment is just the tip of the iceberg, with widespread repercussions for both individuals and financial institutions. Customers have reported stolen funds, and banks are faced with mounting investigation costs, reputational damage, and claims for reimbursement. “This case undermines public confidence in banking systems,” said an FBI spokesperson. “It’s not just about financial losses—it’s about trust.” As the investigation continues, many are questioning the security of modern banking systems and the increasing threat posed by cybercrimes. A Cautionary Tale in a Digital Age Cases like this one reflect the growing risk of fraud in the era of digital banking. As technology evolves, so do the methods used by criminals to exploit it. This incident underscores the importance of strong cybersecurity and public awareness. How to Protect Yourself from Bank Fraud To avoid falling victim to fraud, here are some essential safety tips: Only use official banking apps and websites to conduct financial transactions. Monitor your account regularly and report any suspicious activity immediately. Beware of phishing scams—never provide personal information via unsolicited emails or texts. Taking these simple precautions can significantly reduce your risk of falling victim to fraud. Next Steps in the Jason Norbeck Indictment Case Jason Norbeck is awaiting trial, and if convicted, he faces serious penalties, including prison time and restitution. Federal investigators continue to probe the case, urging anyone with additional information to come forward. The Jason Norbeck indictment case is ongoing. Stay tuned for updates as the investigation continues to unfold. This case is still unfolding. Check back for updates as new developments in the Jason Norbeck fraud investigation emerge.